African Union To Launch Its Own Credit Ratings Agency Next Year To Deal With Unfair Foreign Ratings

The African Union intends to launch a new African credit rating agency next year to tackle the organization’s concerns regarding what it perceives as unjust ratings assigned to countries on the continent.

The agency, which would craft its own assessment of the risks in lending to African countries, would be based on the continent, said Misheck Mutize, lead expert for country support on rating agencies with the African Union.

It will also add context to the information investors consider when deciding whether to buy African bonds or lend privately to countries, Reuters reported.

Mutize noted that there is already substantial interest from the private sector to contribute to the implementation of this initiative.

Credit ratings remain a highly influential tool investors use in their capital allocation. The credit rating industry in Africa is dominated by the three international agencies: Moody’s, S&P and Fitch.

Together, they control an estimated 95% of the credit rating business globally. But the AU, along with leaders from member nations, has, at different times, contended that the “big three” rating agencies’ global ratings do not fairly assess the risk of lending to African countries.

Some of the criticisms are that agencies are swift to downgrade African countries but slow when upgrades are due.

Other complaints include inadequate consultation with stakeholders and perceived shortcomings in independence and objectivity.

However, all three ratings agencies have refuted allegations of bias and maintain that their rating methodologies are consistent.

Ravi Bhatia, S&P’s lead analyst for sovereign ratings, told Reuters recently that the agency applies the same criteria consistently in all regions.

A Fitch Ratings spokesperson said all sovereign rating decisions use “globally consistent and publicly available criteria” and that all rating drivers were clearly identified.

A United Nations Development Programme study in April showed that African countries could save up to $74.5 billion if credit ratings were based on less subjective assessments, citing “idiosyncrasies” in the frequency of rating actions for African countries as an example.

Mutize explained that the new agency was a push to change the narrative.

“Our goal has not been to replace the big three…we need them to support access to international capital. Our view has been to widen diversity of opinions,” he stated.

“We know the big three follow the opinion of other smaller ratings agencies. They’ve acknowledged that other smaller ratings agencies have got an edge in understanding domestic dynamics.”

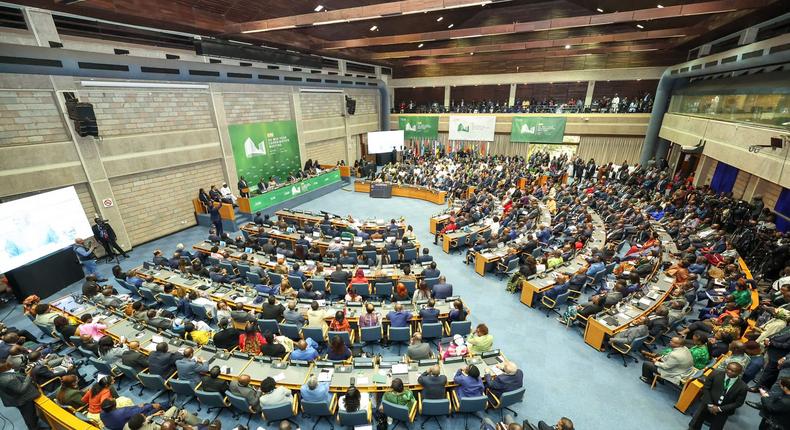

AU finance ministers passed a resolution over the summer to endorse the plan for the new agency, an effort spearheaded by the African Peer Review Mechanism (APRM), a branch of the AU formed last year to improve governance across the continent.

The full AU executive council is expected to adopt the same resolution in February.

According to Mutize, the agency would be self-funded and private-sector driven with AU oversight.

“Investors have been quite positive. They want to see what will be the output of this. Any investor will pay attention to anything that brings them information,” he added.